As widely expected, the Norges Bank left rates unchanged at 2% at the end of last week’s monetary policy meeting. In the Monetary Policy report released after the meeting, the Norges bank indicated that the uncertain outlook on Euro zone economy would postpone the rate hikes previously projected in 2010. Rates are expected to remain unchanged by the time of the publication of Monetary policy report: 3 on October 27th. Rates are also projected to remain on hold by the end of the year versus a previous projection of 2.5%. Key rate is projected to grow to 2.75% by the end of 2011. The new projections clearly indicated that the Norges Bank see the internal economic recovery negatively affected by the European debt crisis. Only in the case the European economy should prove more resilient than expected to the debt crisis the Norges Bank may revise their projections, hiking more aggressively.

venerdì 25 giugno 2010

Bank of England concerned on inflation

BoE's monetary policy minutes of 9/10 June had a major surprise: one member of the Committee (Andrew Sentance) voted against the decision to maintain rates unchanged at 0.5%, preferring an increase to 0.75%. The reason behind his vote was the higher than expected inflation trend in the last few months. However, according to BoE's minutes, inflation developments concerned the whole of Monetary Policy Committee. The minutes underscored that inflation was higher than expected in the last few months and that may remain above target if the private sector’s expectations of inflation over the medium term also rose. The major risks on inflation outlook were the measures to be announced in the budget and the "considerable uncertainties about the margin of spare capacity and the strength of its influence on inflation". Despite one member's vote in favour of rate hike, we believe that the building of a consensus inside the BoE toward a removal of easing monetary policy is hard to envisage in the short term due to moderate rate of growth. Only in the case the substantial margin of spare capacity would fail to lower inflation in H2 '10 the BoE will start considering raising rates.

lunedì 24 maggio 2010

Euro zone economy little affected by debt crisis by now

Over the last week it was visible the effect of last few week’s debt crisis on economic data. The ZEW economic sentiment index fell more than expected in May (from 53 to 45.8 versus market expectations of 47) as institutional investors were concerned that economic growth in the next six months may weaken as a results of uncertainties on peripheral Euro zone countries. However, despite being lower than expected and having worsened in the second half of the month, the index remained well above long term average (27.4), confirming that German economic recovery is expected to continue.

As regards inflation, April figures indicated that headline CPI rose 1.5% y/y and that the CPI core fell from 1% y/y to 0.9% y/y – historical low of the index. April’s figure confirmed that inflationary pressures are subdued due to high unemployment rate and very weak internal demand. Deflationary pressures are likely to emerge in many countries. Should this trend continue, the ECB may decide to cut rates again or decide to not sterilize next government bond purchases.

giovedì 29 aprile 2010

Fed: rates unchanged for an extended period

In the statement released at the end of last week monetary policy meeting, the Fed confirmed the pledge to leave rates unchanged for an “extended period” due to low rates of resource utilization, subdued inflation trends, and stable inflation expectations. As in the two previous meeting, the president of the Federal Reserve Bank of Kansas City Thomas Hoening dissented on maintaining this pledge as he believed “it could lead to a build-up of future imbalances and increase risks to longer run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly”. Albeit confirming that rates will still remain unchanged for some months, the Fomc gave an upbeat picture on US economic outlook, indicating that labour market is improving (it was seen as stabilizing in March) and that consumer spending has picked up. The Fomc reaffirmed that inflation is likely to remain subdued for some time. In the statement released at the end of the meeting the Fomc clearly confirmed that despite economic activity improved in the last few months a rate hike is not on the card. Only a sustained improvement in labour market will be the trigger for the beginning of a tightening monetary policy. Moreover it seems very likely that the Fed will consider the risk to increase rates too later lower than the risk to increase them too early.

martedì 30 marzo 2010

Rescuing Greece

In line with last week’s emerging data, the most likely scenario for the next few years divides the Euro Zone into two, with the major northern European countries growing at a healthy pace and the peripheral southern European countries, including Ireland, remaining in a quandary for several years. On the one hand, the German IFO and French INSEE business confidence indices showed positive gains in March, indicating that the two largest economies in the Euro Zone could accelerate in the coming months. On the other hand, fears about the health of public finances in Greece and Portugal increased after UBS economist Paul Donovan predicted that Greece will fall into default at some point, and after the ratings agency Fitch downgraded Portugal to AA- with a negative outlook, indicating that further economic or fiscal underperformance this year or in 2011 may lead to another downgrade. According to Fitch, “although Portugal has not been disproportionately affected by the global downturn, prospects for economic recovery are weaker than 15 European Union peers, which will put pressure on its public finances over the medium term.”

However, the real commotion continues in Greece. Greek authorities are indeed faced with the particular dilemma of having to refinance a debt of 20 billion Euros between April and May. Only last Thursday, governments of the 16 Euro Zone countries endorsed a Franco-German proposal mixing IMF and bilateral loans at market interest rates while voicing confidence that Greece will need no outside help to cut Europe’s biggest budget deficit.

Nevertheless, the most clear and prominent revelation from data published last week is that the countries called to assist Greece in exiting the crisis are those who are particularly benefiting the most from this situation. Indeed, the most important effect of the Greek crisis in financial markets, in addition to the jump in Greek government yields, was the decline of the Euro against major international currencies. Year to date, the Euro has lost 6% against the U.S. Dollar, 3.7% against the Swiss Franc, 7% against the Japanese Yen and has gained solely against the British pound (1.3%).

A study entitled Standard Shocks in the OECD Interlink Model presented in 2001 by a handful of OECD economists, namely Dalsgaard, Andrè and Richardson, indicated an estimated 0.6% increase in the Euro Zone’s GDP both in the first and second year following a 10% depreciation of the Euro. The projected rise in the inflation rate (+0.4% in the following two years) should not be cause for concern as the ECB projected inflation to remain well below 2% in both 2010 and 2011. The Eurostat’s CPI flash estimate for March set to be published sometime next week should confirm the scenario projected by the ECB: consumer prices at 1% y/y, hence a slight increase from February’s 0.9% y/y. Inflationary acclivity should depend almost exclusively on rising oil prices, while the CPI core, scheduled to be published in the next few weeks, should remain near its all-time low of +0.8% y/y recorded in February.

Figures from the OECD indicated that a decrease in the single European currency caused by the Greek crisis is especially good for Germany and France, whose business confidence indices rose strongly in March. Germany may be the main beneficiary of the Euro’s decline as exports account for 48% of the German GDP.

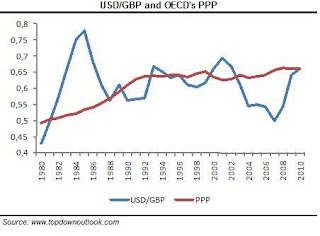

This is especially true considering that the Euro is still overvalued against the US Dollar on the basis of estimated purchasing power parities calculated by the OECD, notwithstanding the recent downtrend. The OECD, in fact, estimated the fair value for the Euro/Dollar at 1.17.

Nonetheless, the Euro’s decline is likewise very positive for its peripheral countries. Another stumbling of the single European currency would enable Greece, Spain and Portugal to gain competitiveness in international markets, promoting an increase in exports, which would appear to be the only factor capable of boosting economic growth in the coming years. A low or negative GDP growth would in fact lead to a further deterioration of public finances.

It would be much more difficult for these countries to gain competitiveness against other European partners. The strong increase in unit labor cost and real exchange rate over the past few years (as indicated in the graphs below) eroded the competitive position of the Euro Zone’s peripheral countries vis-à-vis major countries of the region. Northern European countries, particularly Germany, do not seem to want to give up their model of growth based on exports or implement economic policies to boost domestic demand in exchange for a more competitive Spain, Portugal and Greece (and Italy). European partners are facing a long and arduous process, which must necessarily pass through a stage of very low wage growth, if not negative, with a strong risk of deflation. Thus, while last week’s decision on aiding Greece might reduce tensions on these countries in the short term, overcoming the current crisis for peripheral countries is a process that will take many years.

martedì 23 marzo 2010

The Fed and the markets

International financial markets extended a particularly warm welcome to the Fed's decision at the end of last week’s monetary policy confirming that rates will remain unchanged for an extended period, which was widely expected by economists. Major international stock indices have in fact protracted the upward trend of recent weeks, and Government bond yields remained unaltered despite the overall better-than-expected economic data published over the past week in the U.S.

The Fed’s Fund Rates are likely to remain unchanged for at least another 4 to 6 months (the horizon construed by the markets under the term "extended period" without contradicting the Fed), thus the conditions for a continued upward trend in U.S. equity markets are still well in place, despite the slight S&P500’s overvaluation after the recent rally: the ratio P/average earnings for the past 10 years rose over 20 versus a long term average of 18.

The Fed’s Fund Rates are likely to remain unchanged for at least another 4 to 6 months (the horizon construed by the markets under the term "extended period" without contradicting the Fed), thus the conditions for a continued upward trend in U.S. equity markets are still well in place, despite the slight S&P500’s overvaluation after the recent rally: the ratio P/average earnings for the past 10 years rose over 20 versus a long term average of 18.

The confidence seen in the stock market’s outlook is mainly bolstered up by the fact that until the Fed Fund Rates have begun to rise, the yield curve will continue to be very steep, with the differential between the 10-years and 3-months Government Bond yields remaining well above 300bp. As we highlighted in Global Strategy Weekly’s January 18 report "What Is The Yield Spread Telling Us" (see here for an excerpt), a very steep yield curve is in fact a positive sign not only for economic growth (according to econometrics model presented in past academic studies, the chances of recession under current conditions are almost as high as 0) but also for the U.S. stock market itself.

Since 1953 a strategy consisting in buying the S&P500 when the yield curve is positive and exiting the equity market and investing in T-Bill when the yield curve is inverted has produced a 7.7% average annual compound return against +7.3% of a buy and hold strategy – without considering the returns delivered by T-Bill when no position has taken on equity markets. The average monthly return stands at 0.74% when the yield spread is positive and at -0.2% when it is negative. When the yield spread is above 3% as it is now (this has occurred in 64 months since 1953, 10% of the total), the S&P500 sees a 0.5% monthly return. For this reasons, should the yield spread remain above 3%, we would expect a positive performance for the S&P500, though lower than the historical average monthly return (+0.65% since 1953). A positive performance but slightly below the average would be in line with the slight overvaluation of the S&P500.

The main reason for the S&P500’s good performance, though more generally for all equity markets, is that the presence of a very steep yield curve is historically accompanied by sustained growth of corporate profits in the years ahead. This correlation is clearly shown in the chart below, taken from national accounts data, comparing the spread between the 10-year and the 2-year government bond yields with the developments in corporate profits in the following three years.

Set to be published on Friday 26, the final national accounts data for Q4 (the GDP growth is likely to be confirmed at 5.9% q/q annualized) should confirm that corporate profits, following the sharp decline in the last two and a half years, are returning to healthy growth: having grown by 10.7% q/q in Q3 '09, profits may rise by 3.8%, remaining almost 15% below the peak in Q3 '09.

Even the bond market will be strongly influenced in the short term by Fed's decision to leave rates unchanged for an extended period. The flattening of the yield curve that we expect in the coming months is likely to be delayed. Moreover, a very steep yield curve has usually been followed by a decline in long term rates and an increase in short term rates.

Nevertheless, we believe that the expectations of the consensus of economists in the Livingston survey, conducted by the Federal Reserve Bank of Philadelphia last December (rating the U.S. 10-years government bond yield could rise to 4.1% at the end of 2010, and 4, 64% by the end of 2011), reflect assumptions too optimistic about US economic growth perspective, and too pessimistic on inflation in the next few months.

Indeed, despite economic recovery signal emerged in the last few months, the last two years crisis is likely to have reduced the growth potential of the U.S. economy. In particular, the deleveraging process that would take place both in the households and business sector should take its toll on economic growth for several years.

Data released this week indicated that there are no signs of inflationary pressures in the short term. In contrast, in February, core inflation fell to 1.3% y/y, the lowest level since February 2004, while overall inflation has fallen from 2.6% y/y to 2.1% y/y.

Unless an unexpected surge in inflation, the causes of whom are very difficult to envisage, we do see the potential for long-term Government bonds to gain positive returns in the next few months.

mercoledì 17 marzo 2010

Commodities update

Over the first 3 months of 2010, major commodities recorded a very positive performance. Between the major ETFs and ETCs listed on the Italian Stock Exchange, ETCs on gold, silver and oil had some of the most brilliant results, rising by 5.7%, 5.7% and 6% respectively. However, the ETF based on the CRB Commodity Index was substantially unchanged in early 2010.

When considering the major international asset classes that can be replicated with Italian ETFs, only European equity emerging markets, US equity indices and the Japanese equity market had better performances.

However, the aforementioned commodities gained sound performances since the beginning of the year almost exclusively for European investors. Indeed, the performances were largely dependent on the decline of the Euro’s exchange rate versus the U.S. Dollar, as year to date gold and silver rose by just over 2% and oil by about 3%. The CRB Index dropped by 3.3%.

Various factors are at the root of the behavior of gold and silver differing from the CRB Index of commodities. Gold and silver in fact benefit from fears that expansionary monetary policies by major international central banks could lead to higher inflation over the next months. The expected increase in public debt over the next few years is another source of concern. The sum of public and private debt may create financial instability in the majority of developed countries. In this scenario, and in view of low interest rates on both sides of the Atlantic, the cost opportunity to maintain gold or silver in the portfolio is very low. Moreover, precious metals could continue to benefit over the coming months from purchases by many central banks, especially the People’s Bank of China, looking to diversify reserves to limit its exposure to the U.S. dollar.

However, the CRB Index is reacting to expectations that monetary policy in China could become more restrictive over the coming months, slowing its demand for raw materials. The Chinese economy, in fact, was one of the main engines of growth during 2009 under the force of a massive Government fiscal stimulus program. Data published Thursday 11 have shown that the Chinese economy may overheat. Inflation, in fact, increased by 2.7% y/y against consensus expectations of 2.5% y/y; and may rise, according to some Chinese economists, within a couple of months to 3%. But the main source of concern for Chinese authorities is the trend of private sector credit. New loans to the private sector rose by 700bn Yuan in February, down from 1300bn in January, but higher than the 600bn expected by consensus. These numbers make it difficult to achieve the target for new loans of 7500bn in 2010, representing a decrease of 22% compared to 2009. This may in turn lead to higher interest rates over the coming months for the first time since December 2007.

The behavior of oil prices presents a challenge in itself, especially since supply on the market seems to be much higher than demand. However, the rise in oil prices in the short term may be influenced more by expectations of continuing international economic growth, as evidenced more by the correlation between the U.S. ISM Manufacturing Index and oil prices, than by the actual dynamics between demand and supply.

The early 2010 increase has not changed the outlook for precious metals in the upcoming months for a number of reasons. Firstly, easing monetary policies by major central banks and fears about the state of public finances should remain for several months, or even years with regard to the latter. Secondly, gold and silver have maintained an even keel during the crisis over the last 3 years on their capacity to offer sound diversification from the stock market. The correlation between gold and the S&P500 has in fact remained below 0.1 (the correlation ranges from 1, maximum correlation, and -1, inverse correlation), while the correlation between silver and the S&P500 increased to 0.17. Much higher, however, was the correlation between the S&P500 and the CRB Index (0.5), suggesting that the CRB is no longer able to ensure adequate portfolio diversification. Likewise around 0.5 is the correlation between oil prices and the S&P500 over the past 3 years.

For these reasons, it would still makes sense to invest in at least one of the products related to trends in precious metals, whereas to invest in the general index of raw materials or oil would be riskier and inefficient.

Notwithstanding the above, caution should be exercised when investing in gold and silver given the strong optimism that currently surrounds them, negative from the contrarian perspective. Mark Hulbert, for instance, showed that the Hulbert Gold Sentiment Index (HGSI), which reflects the average recommendation of a specialized series of newsletters on gold, has risen to 46.6% last week compared to 32.3% in early February. All of this in spite of virtually unchanged yellow metal prices.

Even very optimistic price targets from several major investment banks fade quietly in the short term. For instance, Goldman Sachs recently issued a report predicting a rise in gold prices up to USD 1,400 an ounce. Much more optimistic was Charles Morris of HSBC, saying that gold will rise until USD 5,000 an ounce in five years. In the face of such forecasts, one might recall Goldman Sachs’ prediction in May '08 that oil would reach USD 200 a barrel. The month after, oil reached a historical record of USD 145 a barrel before plunging down to 30.

venerdì 12 marzo 2010

A follow up on UK negative outlook

In our post Forget UK! we have indicated the reasons why we believe it is unsafe investing in UK asset classes now. A reminder of negative UK economic outlook came today from a Telegraph article that reported words from Kornelius Purps, Unicredit 's fixed income director. He said "I am becoming convinced that Great Britain is the next country that is going to be pummelled by investors". He also said "Britain's AAA-rating is highly at risk. The budget deficit is huge at 13pc of GDP and investors are not happy. The outgoing government is inactive due to the election. There will have to be absolute cuts in public salaries or pay, but nobody is talking about that," and "Sterling is going to fall further over coming months. I am not expecting a crash of the gilts market but we may see a further rise in spreads of 30 to 50 basis points".

These words strenghten our negative view on UK...

For the entire article look here: http://www.telegraph.co.uk/finance/economics/7423138/Europes-banks-brace-for-UK-debt-crisis.html

mercoledì 10 marzo 2010

Forget UK!

Last week, the BoE decided to leave rates unchanged at 0.5% and to forestall expanding on its GBP 200bn asset-purchase program, which was widely anticipated by the whole of economists in the Bloomberg consensus. It was hard to see any reason for the BoE to change the outlook for monetary policy in the short term, having decided to pause the program in February.

The latest economic data confirmed that the wait-and-see stance recently adopted by the BoE is appropriate. Over the last week, GDP growth in Q4 was revised upwards from 0.1% q/q to 0.3% q/q; the CIPS Manufacturing Index remained well above 50 in February (56,6, unchanged from January); and the CIPS Services Index rose from 54,5 in January to 58,4 in February. However, these data confirmed that the UK economy is likely to grow at a moderate pace in the next few quarters and will not recover the pre-crisis growth trend for many years, as BoE’s Governor Mervyn King stressed in the press conference for the presentation of February’s Inflation report.

Neither the higher than expected increase in inflation is likely to change the monetary policy outlook in the short term. Indeed in January inflation jumped from 2.9% y/y to 3.5% y/y, requiring the BoE’s Governor to write a letter to the Chancellor to explain the reasons for the CPI leaping above 3%. Three factors have driven inflation up: 1) standard VAT rate restoration to 17.5%; 2) oil price increases over the past year; 3) exchange rate weakness. While inflation is expected to remain well above 3% in the short run, Mervyn King confirmed that inflation will fall below 2% in H2 ‘10. Only in the case the expected downtrend in inflation fail to materialize, the BoE monetary policy outlook will change.

However, even if inflationary pressures prove to be higher than expected, we do not see the BoE tightening up monetary policy. Indeed, an increase in inflation would contribute in solving a major problem in the UK economy: the high level of total debt compared to GDP. According to data published in the McKinsey Group’s report “Debt and deleveraging: The global credit bubble and its economic consequences”, the UK has a total debt/GDP ratio of 466%, compared to 296% in the USA and 285% in Germany. Only Japan at 471% has a higher ratio.

The high debt/GDP burden will likely drag the UK economy as both household and business sectors should embark on a deleveraging process in the years ahead. Consumer spending and business investments are likely to remain moderate for many years. A different trajectory is likely to be taken by public debt, which is expected to grow considerably in the next few years. The projections in the 2009 budget see an increase in public debt from 71.9% in fiscal year 2009/2010 to 82.1% in 2010/2011, reaching 90.7% in 2013/2014. However, in the next few years, even government spending is likely to be put under control facing these large deficits.

Weak domestic demand and high levels of debt are factors that may contribute to a BoE’s expansionary monetary policy for a lengthy period and, moreover, longer than its major trading partners. In fact, a more protracted monetary easing from the BoE compared to the Fed and the ECB, in view of a higher level of inflation, will lead to further depreciation of the Pound in the coming months, hence favoring exports. In fact, exports at this time seem to be the British economy’s only hope for a return to sustainable growth. BoE’s Governor King has on many occasions pointed out that a depreciation of the Pound would be welcomed, highlighting the positive role of a weaker Sterling in increasing the profits of export companies and limiting deflationary pressures (which are still seen as the chief reason for concern within the Bank of England).

Thus, the Sterling’s fall in value since the beginning of the year against both the US dollar (-7%) and the Euro (-2%) is likely to be seen favorably by the Bank of England. The decline in early 2010 resulted in a Sterling that is fairly valued versus the US Dollar based on the OECD’s estimate of Purchasing Power Parity and 15% undervalued against the Euro.

The decline of the Pound against the Euro and the US Dollar had a negative impact on both European and U.S investment in British assets. A clear example of this is the trend of some ETFs on British assets quoted on Italian equity markets: DB Trackers Eonia, Ishares Ftse UK Gilt and Ishares Ftse100.

The former has lost 1.7% year-to-date, while the ETF specializing in long-term bonds has gained 0.8% year-to-date, though it has lost 0.6% compared to March ‘09 due to higher yields.

However, the negative impact of developments in the British Pound on asset performance is very clear when looking at the development on the FTSE100’s ETF. Therefore, compared with the 2.1% year-to-date gain recorded by the FTSE 100, the best performance among the major stock markets in Europe, the ETF we took into account has gained only 0.9%.

These performances are a reminder of the words delivered in January ’09 by Jim Rogers, co-founder and former member of the Quantum Fund, angering many British investors and commentators: "Sell any Sterling you might have. It's finished. I hate to say it, but I would not put any money in the UK”. As long as the outlook on the Pound is not stabilized, which does not appear likely in the short term due to numerous uncertainties about the outlook of the British economy, not least the result of forthcoming elections, the advice of Rogers still has relevance.

mercoledì 3 marzo 2010

Waiting for a warmer spring

Economic data published in the past weeks came in generally weaker than expected in both the USA and the Euro Zone, increasing uncertainties on the sustainability of the current economic recovery and revitalizing downward pressures on major international equity markets.

In the USA, the Conference Board’s Consumer Confidence Index disappointed investors, as it fell more than 10 points to 46, its lowest readings since April 2009. Economists forecasted that confidence would dip to 55 from a previously reported 55.9 for January (revised to 56.5). The rise in initial jobless claims related to bad weather conditions and eroding opinions on Washington are likely to be the main reasons behind the huge decline in consumer confidence – at least according to the Conference Board’s readings. The decline in the Consumer Confidence Index implies caution on the consumer spending outlook, despite the fact that academic studies published in the past years have yet to come to a clear conclusion on the link between consumer confidence and consumer spending.

The real estate sector is seeing negative indicators coming from new home sales figures, which fell by 11% in January to its lowest level on record, signaling that the extended Government tax credit may be insufficient to rekindle demand in the short term. Investors were also disappointed by the decline in durable goods orders, ex-transportation (-0.6% m/m versus market expectations of 1% m/m) and by the rise in initial jobless claims (+22k to 496k).

In the Euro zone, the IFO Business Climate Index fell in February for the first time since April ‘09 – from 95.8 to 95.2 – versus market expectations of an increase to 96. The index indicated that the German economy, having stalled in Q4 ‘09, may grow at a very subdued pace in early 2010.

Adverse weather conditions are generally considered to be the main reasons behind the negative surprises in the last few weeks. Indeed, the first two months of 2010 have seen temperatures well below seasonal average, and widespread snowstorms in both the USA and the Euro Zone have accompanied slackened economic activity.

Thus we expect fairly weak economic data to be published in the next few weeks with regard to January and especially February.

The first test of strength for our expectations will be the ISM Manufacturing Index and employment data for February in the USA – due to be released on Monday 1 and Friday 5 respectively. No major data on Euro Zone economic activity are set for publication next week. We expect the ISM Manufacturing Index to remain unchanged vis-à-vis January owing to the positive outlook for exports, but we see the labor market further weakening: non-farm payrolls are likely to decline by 30k in February compared to the 20k decline in January.

With data on economic activity in January and February lower than expected, US and Euro Zone economic growth in Q1 ‘10 is likely to be weaker than previously forecasted by economists. The US economy is unlikely to repeat its 5.7% q/q ann. of Q4, while economic growth in the Euro Zone may also prove as anemic as in Q4 ‘09 (+0.1% q/q).

Consequently, corporate earnings in Q1 ‘10 are likely to be lower than projected by analysts. These underperforming earnings are likely to exert further downward pressure on equity markets and bond yields in the short term.

However, should the slowing down in early 2010 turn out to be merely temporary, we may expect economic activity to rebound in the next few months. In fact, Fed economist Martha Starr-McCluer emphasized this in the working paper “The Effects of Weather on Retail Sales”. While monthly data show considerable evidence of weather-related dips, the quarterly data nevertheless attest to fewer effects, and the explanatory power associated with the weather variable is generally quite modest. In this case, a rebound of equity markets and bond yields is a clear possibility.

Nonetheless, the absence of a spring economic rebound would be a clear signal that economic activity in all 2010 will be very disappointing. This scenario would drag down equity markets and bond yields even further, and the Fed would thus maintain Fed Fund Rates unchanged for an extended period.

martedì 2 marzo 2010

Canada: better than expected GDP growth but the BoC left rates unchanged at 0.25%

Canadian economy rose by an annualized 5% in Q4 ’09. Economists expected GDP to increase by 4% and the Bank of Canada had projected a 3.3% gain in the January 2010 monetary policy report. Statistics Canada revised its estimate of the Q3 growth rate to 0.9% from the earlier reading of a 0.4% pace. Q4 had solid gains in most of the major domestic expenditure categories: consumer spending rose 3.6%, residential investment 29.7% and government spending 5.8%. Business investment was the main source of weakness dropping 8.8%. On the external side of the economy, exports rose a robust 15.4% that more than offset an 8.9% rise in imports, which resulted in net exports adding 1.5 percentage points to overall fourth-quarter GDP growth.

Stronger than expected GDP growth did not have short-term consequences on the BoC monetary policy. The BoC left rates unchanged at 0.25% at the end of last week monetary policy meeting and repeated a pledge to leave it unchanged through June unless the “current” inflation outlook shifts. As regards economic activity the BoC said that “The level of economic activity in Canada has been slightly higher than the Bank had projected in its January Monetary Policy Report” and that “the persistent strength of the Canadian dollar and the low absolute level of U.S. demand continue to act as significant drags on economic activity in Canada”. On inflation, the BoC highlighted that “Core inflation has been slightly firmer than projected, the result of both transitory factors and the higher level of economic activity” and that “main macroeconomic risks to the inflation projection are roughly balanced”. The bank’s statement dropped a reference made in January to inflation risks being “tilted slightly to the downside.” and omitted a reference to the central bank having “flexibility” even with the key interest rate close to zero. While we do not see the BoC raise rates before H2 ’10, we believe that the BoC may increase rates aggressively. Indeed, our interest rate rule indicate that the BoC has the possibility to hike rates considerably (e.g. to 2%) before the end of 2010.

Reserve Bank Of Australia raised rates to 4%

The Reserve Bank of Australia raised rates by 0.25% to 4% during today's, as 14 of 19 economists in a Bloomberg survey predicted. In the statement published after the monetary policy meeting, the RBA’s Governor Glenn Stevens said that “Labour market data and a range of business surveys suggest growth in the economy may have already been at or close to trend for a few months” and “the Board judges that with growth likely to be close to trend and inflation close to target over the coming year, it is appropriate for interest rates to be closer to average”. The outcome of last week’s monetary policy meeting indicated that the RBA is likely to continue tightening monetary policy in the months ahead. The cash rate may be raised to 4.75% by year-end, with a rate hike delivered every couple of months.

martedì 23 febbraio 2010

Japanese economic trouble: why we should underweight japanese financial markets

An excerpt form our latest Top Down Outlook. Go on our website for a 1 month free trial.

Over the last few weeks, investors have been focusing on the negative outlook for peripheral Euro Zone countries, especially Greece, due to their high deficit and public debt. However, albeit at a slower pace, uncertainties over the future of public accounts concern a vast majority of developed countries. For instance, public debt, in % of the GDP, may rise to 65% in the USA, 88.2% in the UK in 2011 and 83.7% in the Euro Zone as a whole.

Over the last few weeks, investors have been focusing on the negative outlook for peripheral Euro Zone countries, especially Greece, due to their high deficit and public debt. However, albeit at a slower pace, uncertainties over the future of public accounts concern a vast majority of developed countries. For instance, public debt, in % of the GDP, may rise to 65% in the USA, 88.2% in the UK in 2011 and 83.7% in the Euro Zone as a whole.

Notwithstanding the above, the country that may suffer the most in the next few years due to elevated public debt is Japan. Indeed, public debt ballooned in the last two decades from 59% of the GDP in 1990. Further, the International Monetary Fund estimates that debt may have risen to 218% in 2009, and thus could reach 227% and 246% in 2010 and 2014 respectively. This jump in public debt substantially replaced the falling private sector debt, increasing the level of total debt/GDP, according to data from McKinsey Global Institute, from 420% in 1995 to 471% in Q2 ‘09. We used 1995 as a benchmark year, since this is when non-financial business debt reached its highest level (148% of GDP). After 1995, non-financial business sectors began a deleveraging process that finished only recently (non-financial business debt fell to 91% of the GDP in 2005 and now stands at 95% of the GDP).

Despite the huge increase in public debt and the estimated further increase in the years ahead, government bond yields have remained very low. The 10-year Japanese Government Bond yield has been below 2% since 1998, with no meaningful changes over that period. By now, Japan holds the record for both the highest general government debt and the lowest long-term government yield among developed countries; which is in stark contrast with economic theory.

The grounds for this “conundrum” are explained in a recent working paper “The Outlook for Financing Japan’s Public Debt” by IMF economist Kiichi Tokuoka, who enumerated the factors behind the low and steady JGB yields:

1) Large pool of household assets: household saving rate was around 10% until around 1999 when it began to decline sharply;

2) Strong home bias: JGBs have been financed largely by domestic investors (94 %of holdings as of end-2008), who may exhibit more stable behaviour than foreign investors. The strong home bias is driven by the household sector whose appetite for risk assets has remained weak. The share of currency and deposits in households’ financial assets is as high as 55% (at end FY2008)—well above 16% in the U.S.—and a large part of these funds is invested in JGBs mainly through the banking sector;

3) Existence of large and stable institutional holders as the Japan Post Bank and the Government Pension Investment Fund;

4) Recent large saving flows from the corporate sector.

Nevertheless, Tokuoka explained that structural shifts in the Household Balance Sheet and key market players could weaken the absorptive capacity of the JGB market, making yield more sensitive to the debt level. For instance, the role of the household sector in providing funds to the JGB market is likely to decline as the savings rate may further fall from the current level (2.2% in 2007). The author’s simulation indicated that, based on current trends, the gross public debt in 2015 could exceed gross households’ financial assets, that is, of course, assuming that the household saving rate remains at 2.2%.

Tokuoka concluded that it would be critical to establish a credible framework over the medium term to ensure fiscal sustainability. The framework would need to feature a clear timetable for comprehensive tax and expenditure reforms to be implemented once the economy recovers.

However, a shift in the expansionary fiscal policy adopted by the Government in the last few years is not yet on the horizon. The latest macroeconomic data, while posting a better than expected growth of 1.1% q/q GDP in Q4 ‘09, indicated that economic growth is mainly driven by exports in spite of the surprising rebound of both consumer spending and business investment. The most worrying aspect of Q4 GDP figures, however, was the 0.9% q/q decline of the GDP deflator – a 54 year low.

Deflation weighs on the Japanese economy in two ways: 1) it weakens consumer spending, and 2) it dampens business investments because real yield is higher than in the rest of the developed world.

This negative situation will unlikely change in the short term as the output gap is indeed very wide (about 7% according to the Cabinet Office’s estimate for July-September 2009), and a meaningful recovery is not expected over the next few months. Moreover, internal demand is likely to remain weak as wage declines are influencing sales over a broad range of discretionary goods, and investment spending will unlikely pick up considerably due to uncertainties on current economic recovery. For these reasons, only further significant improvements in exports could trigger a sharper upturn in the economy.

On the other hand, increases in exports are limited by the Yen's sharp appreciation in recent months, particularly against the U.S. Dollar and, consequently, the Chinese Yuan, which is pegged to the U.S. currency. Compared with its June 2007 peak, the Yen has advanced by over 27% against the U.S. Dollar, eroding profit margins for the nation's exporting companies. Based on the OCSE Purchasing Power Parity estimate, the current level of the Yen surpasses an overvaluation of 25% against the U.S. Dollar.

Therefore, a devaluation of the Yen is the most efficient way to spur growth in Japan’s economy in the short term, even though it appears difficult to implement, given that almost all major international economies rely more or less heavily on their currency devaluation to revive the economy. Moreover, both the Bank of Japan and the Treasury Minister seem to have limited possibility to implement further policy action to stimulate the economy. Last week, the BoJ left rates unchanged at 0.1% and did not take decision on its quantitative easing program.

All the same, we believe that should the Japanese Yen’s upward trend versus the U.S. Dollar resume in the months ahead, the Bank of Japan will be ready to take extraordinary measures to weaken the exchange rate, i.e., increasing lending term facility for commercial banks or raising government bond purchases. Fiscal deterioration is another factor prompting a decline of the Japanese Yen. We believe that there are no likely prospects of the Japanese Yen strengthening beyond its current level in the months ahead.

For this reason, we would not invest in any asset classes denominated in Japanese Yen. The Japanese equity markets have underperformed other major international equity markets. Thus, in view of potential Yen devaluation in the medium term and low bond yields, we recommend not to invest in the Japanese bond market.

Finally, the economic scenario for the Japanese economy we have depicted above reinforces our recommendation to BUY the AUD/JPY exchange rate, which fell in the previous weeks due to a surprising RBA decision to leave rates unchanged at 3.75% at February’s monetary policy meeting in conjunction with the increase in risk premiums on international financial markets. However, the AUD/JPY rebounded last week as the RBA made clear in the minutes of February’s monetary policy meeting that the tightening monetary policy will resume in the next few months. Following the higher than expected increase in employment in December, we foresee the RBA hiking rates to 4% as soon as in March. We continue to expect the Australian and Japanese Central Banks to each implement a highly restrictive and expansionary monetary policy in 2010 among major Central Banks, making the AUD/JPY the favorite exchange rates for carry traders.

mercoledì 17 febbraio 2010

Momentum indicators still say overweight equity

An excerpt form our latest Top Down Outlook. Go on our website for a 1 month free trial.

Following the sell-offs of recent weeks, major international equity markets continue brandishing negative performances since the beginning of 2010: The S&P500 has declined by 3,55%, the DJ Eurostoxx by 8,22%, the Nikkei by 4,3% and the FTSE100 by 4,99%. Emerging markets as a whole also have kindled negative performances in 2010: the MSCI Asia fell by 5,9%, the MSCI European emerging by 3,8% and MSCI Latin America by 3,7%.

Nonetheless, we have also maintained a BUY rating on many equity markets; especially those in emerging countries (see 1 February’s “Global Strategy Weekly – Equity Emerging Markets Outlook”). Among the equity markets in developed countries, we have a BUY recommendation on the Nasdaq 100. In 1 February’s report, we have underlined all the fundamental reasons behind our decision to confirm our rating on those markets. However, an important reason for this rating is that we are great followers of momentum strategies and these markets are still in an upward trend. In this week’s “Global Strategy Weekly”, we will be analyzing what the most popular momentum strategies say on the perspectives of major international financial markets.

Considering the 30 major asset classes identified among the Italians ETF (stock markets, bonds and commodities), the six financial markets that this strategy suggests as overweight now are: equity Eastern Europe, equity Latin America, equity Emerging Asia, equity Africa, equity China and the Nasdaq 100. With the exception of China, which we do not include in our portfolio due to fears of excessive credit growth in 2009 (as we explained in 19 December’s Top Down Outlook), these are the asset classes that we overweighed in our Top Down Portfolio (Equity emerging Asia has been recommended since 19 December, the whole of the other equity markets since the inception of the portfolio on 5 December).

Even renowned strategists and economists now differ on the outlook of equity markets over the next few months, especially with regard to the S&P500. Barton Biggs, chief global strategist at Morgan Stanley from 2003 to 2007, and now head of the hedge fund Traxis Partners, recently said that valuations are ok, and that there are a number of good opportunities on the market. Last September, Biggs said that the S&P500 may climb to 1350 in 2010. However, according to New York University Professor Nouriel Roubini, the stock market will be flat or almost unchanged at the end of the year. More pessimistic is the outlook depicted by Jeremy Grantham, chief investment strategist at Grantham Mayo Van Otterloo & Co, who said investors should underweigh stock because the S&P500 is above what he believes to be its fair value at 850.

As we indicated in 11 January’s “Global Strategy Weekly” , we believed that the S&P500 was slightly overvalued at the beginning of the year according to our long-term valuation model, which analyses the average earnings for the past 10 years, the average earnings annual growth rate and the average P/E for the past 30 years. Following last week’s sell off, investors may now expect a compound return of 6% in the coming 10 years, slightly below the actual historical average return of 7%, but above the average of 5.4% predicted by the model in the past.

Nonetheless, we have also maintained a BUY rating on many equity markets; especially those in emerging countries (see 1 February’s “Global Strategy Weekly – Equity Emerging Markets Outlook”). Among the equity markets in developed countries, we have a BUY recommendation on the Nasdaq 100. In 1 February’s report, we have underlined all the fundamental reasons behind our decision to confirm our rating on those markets. However, an important reason for this rating is that we are great followers of momentum strategies and these markets are still in an upward trend. In this week’s “Global Strategy Weekly”, we will be analyzing what the most popular momentum strategies say on the perspectives of major international financial markets.

Momentum strategies have been the subject of a long series of working papers in academic literature that indicate how they are able to generate significant extra yields. One important report by Jegadeesh and Titman, "Returns to buying winners and selling losers: Implications for stock market efficiency", published in The Journal of Finance (1993, Issue 1), prominently demonstrates this theory. In this report, the two authors affirmed that the strategy of buying securities which, during the last period (3 to 12 months earlier) had achieved the best performance, gained positive abnormal returns during the period 1965/1989 in the U.S. market. For instance, the strategy which selects stocks based on their past 6-month returns and holds them for 6 months realizes a compounded excess return of 12.01% per year on average. This is an important verification by the two authors that these returns were not due to the presence of systemic risk or a delayed reaction to common factors. This study was followed in subsequent years by several reports related to other international equity markets that found similar results.

Leaving aside what might be the causes of these results, we are going to examine the results of a very simple momentum strategy with reference to the major international asset classes. We will take some Eurizon’s mutual funds (Eurizon is one of the bigger asset managers in Italy) as a benchmark, not in order to judge their goodness, but in order to assess the actual return achievable by an Italian investor in the past 11 years using momentum strategy. We evaluated 10 mutual funds that invest in different asset classes: as regards the stock markets, we considered funds invested in Asia, Europe, Japan, Italy, North America and Nasdaq100; and as regards bond markets, we considered funds invested in Euro medium/long-term Government Bonds, Euro short term bonds, US Dollar bonds and emerging markets bonds. The strategy consists of: at the end of the month to buy the 3 mutual funds (out of 10) with the best year-over-year performance and keep them in the portfolio until the end of the following month, and then make a new selection. The chart below indicates that such a strategy would have granted an investor a performance close to 60% from 1999, compared to 6% which would be recorded dividing the initial investment in equal shares in each of the funds.

Considering the 30 major asset classes identified among the Italians ETF (stock markets, bonds and commodities), the six financial markets that this strategy suggests as overweight now are: equity Eastern Europe, equity Latin America, equity Emerging Asia, equity Africa, equity China and the Nasdaq 100. With the exception of China, which we do not include in our portfolio due to fears of excessive credit growth in 2009 (as we explained in 19 December’s Top Down Outlook), these are the asset classes that we overweighed in our Top Down Portfolio (Equity emerging Asia has been recommended since 19 December, the whole of the other equity markets since the inception of the portfolio on 5 December).

Choosing these assets would appear to go against the trend of recent weeks, which saw major stock markets trend downwards. However, this should not come as a surprise when considering that the buy or sell indications of momentum strategies lags behind the reversal of the trend. On the contrary, the decline of recent weeks afforded investors, who had not entered the equity markets in recent months, to possibly invest with a better risk/return profile than at the beginning of the year. In fact, after the fall, most of the stock markets were brought closer to what is seen as a watershed between upward and downward trends: the 10-month moving average. In the following table, we have highlighted the results of a very simple trading system: buy an equity index when the closing price is greater than the 10-month moving average and exit the market when the closing price is lower. Performances using this simple strategy are rather positive (we did not consider the gains from bond markets in the months when we were not investing in equity markets).

We have also highlighted the distance of the current close from the 10-month moving average. A combination of the two previous strategies could be used to buy equity markets currently indicated by the momentum strategy, setting a stop loss below their respective 10-month moving averages to limit losses in the case of reversal of the long-term upward trend.

lunedì 15 febbraio 2010

The Week Ahead in US: CPI and capacity utilization most important data

Empire Manufacturing Index (Tuesday 16) – The Empire Manufacturing Index rose in January to 15.9 from 4.5 in December, indicating improved conditions for the manufacturing sector in early 2010 in the New York area. The data was substantially in line with indications coming from the ISM Manufacturing Index as regards the USA as a whole. The index is likely to indicate that industrial production will continue to trend upwards in the months ahead, remaining almost unchanged at 15.2. The equity markets’ decline in the past few weeks is likely to be the main reason behind the slight downtick in the index.

NAHB Housing Market Index (Tuesday 16) – Confidence among US Homebuilders dropped in January from 16 to 15 – its lowest level since June ’09. We expect the index to rebound to 16 in February, as real estate may begin feeling the effects of the tax credit extension and expansion for home buyers.

Housing Starts (Wednesday 17) – Housing Starts tumbled by 4% to 557k in December, with poor weather conditions probably taking their toll on the data. With weather conditions still negative for the sector in January, housing starts may have continued falling over the month: we estimate a 2% m/m decline to 545k. Housing Starts are likely to rebound in the months ahead thanks to a tax credit extension to June.

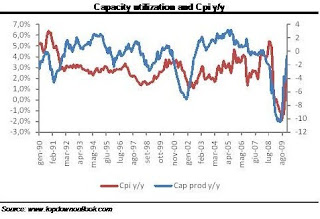

Industrial Production and Capacity Utilization (Wednesday 17) – Business confidence indexes rose in January (the ISM Manufacturing Index marked its highest level since August 2004), anticipating a continuance of the upward trend in industrial production. In line with the increase in the index of aggregate weekly hours, we estimate industrial production to rise by 0.5% m/m in January. Compared to January ’09, industrial production may rise by 0.9%, the first year-on-year positive change since March ’08. Capacity utilization is likely to increase to 72.3% from 72%. The index should nevertheless remain well below its historical average (80.6%), indicating soft inflationary pressures in the months ahead.

FOMC Minutes (Wednesday 17) – In line with our estimates, the FOMC upgraded its view on the US economic outlook in a statement released after its 27 January Monetary Policy Meeting. The FOMC confirmed that “economic conditions, including low rates of resource utilization, subdued inflation trends and stable inflation expectations are likely to warrant exceptionally low federal fund rate levels for an extended period of time”. However, this opinion was disputed by Kansas City Fed President Thomas Hoening, who said in the press release that “financial conditions had changed sufficiently that the expectation of exceptionally low levels of the Federal funds rate for an extended period was no longer warranted”. The minutes of the latest monetary policy meeting will furnish more insight on the particular views of the members of the Board of Governors concerning the economic outlook. In particular, it has to be seen whether other members, aside from Hoening, would have preferred removing the expectations of a low level Federal Funds rate for a long period, but might have decided to concur with the majority.

Consumer Price Index (Friday 19) – The Consumer Price Index rose to 2.8% y/y in December from 1.9% y/y in November, exclusively for the base effect in energy prices. The core inflation edged up to 1.8% y/y from 1.7% y/y in November, due to higher vehicle prices that were only partially compensated by shelter prices (unchanged m/m in December). We expect consumer prices to increase by 0.2% m/m and by 2.7% y/y in January as inflationary pressures are likely to remain subdued in the short term, hence reflecting low pricing power. Core inflation may edge up 0.1% m/m to 1.7% y/y.

venerdì 12 febbraio 2010

Central Bank Monitor: BoE and Riksbank on the spotlight

Bank of England:

At the press conference on the Inflation Report, the BoE’s Governor King confirmed that the decision to forestall purchasing government bonds was not definitive, and that its extension could be decided if consumer prices became worse than previously estimated. As for the projections on economic activity and inflation, the BoE has slightly lowered its estimates on GDP growth and raised its estimates on inflation in the short term, vis-à-vis November’s Inflation Report. The growth rate of GDP is projected to be about 3% y/y in late 2010, and to surge at the same pace in 2011 should interest rates coincide with market expectations, or scend by 4% should rates remain steady at 0.5%. Nonetheless, Governor King stressed that the British economy will not recover the pre-crisis growth trend for many years. Inflation is foreseen to breach 3% y/y during the first part of 2010, probably in January, mainly due to the disappearance of the temporary VAT reduction. Towards the end of 2010, inflation should submerge below 1% and should not buoy up to 2%, the targeted high tide in two years. With inflation expected to remain below the 2% mark at a two-year horizon, a wide output gap expected for the long haul, and a fiscal policy that could become more restrictive in the coming months, we think that the Bank of England should find little reason to raise rates substantially in the near future. We pencil in the BoE to raise rates only by the end of 2010 and only after the Fed and the ECB have decided on a similar action.

Riksbank:

As widely expected the Riksbank left rates level at 0.25% at the end of last week’s monetary policy meeting. In the Monetary Policy Report, the Swedish Central Bank revised the CPI projection for 2010 upwards, from 0.8% to 1.6%; and slightly downwards for both 2011 (from 3% to 2.9%) and 2012 (from 3.6% to 3.1%). As regards economic growth, the GDP is expected to climb by 2.5% in 2010 against the 2.7% projected in December’s Monetary Policy Report update. This is the result of both the improved functioning of financial markets and positive economic indicators, signaling that economic recovery stands on much firmer ground. The Riksbank anticipated monetary policy normalization as the first rate increase in now expected during the summer or early autumn (in December it was expected in autumn). At the same time, the current assessment is that the Repo Rate increase may occur more gradually and its forecast in the longer term has therefore been adjusted downwards slightly. The Repo Rate is expected to grow to 1.25% in Q1 2011 (previous estimate at 1%) and to rise to 3% only at the end of 2011 and not in Q3 2011 as previously expected. The real Repo Rate has been revised upwards, but will remain negative during 2010.

mercoledì 10 febbraio 2010

Riksbank outlook: no rate hike on the radar screen

At December’s monetary policy meeting, the Riksbank decided to leave the repo rate unchanged at 0.25%. The Central Bank also confirmed its previous path estimate of the rate for the coming years, as it is expected to remain steady at the current level until autumn 2010, then rise to 0.5% by the end of 2010, to 2.5% by the end of 2011, and to 4.25% by the end of 2012. The Riksbank is widely expected to leave the rate unchanged at 0.25% and to confirm the previously estimated rate path in the Monetary Policy Report released at the end of the meeting. The report will also contain the new projections on the progress of inflation and economic growth. Deputy Governors Nyberg and Wickman-Parak may enter yet a third consecutive reservation against the repo rate path. During December’s monetary policy meeting, they considered that it would be necessary to raise interest rates sooner than indicated by the proposed interest rate path, but that the path would consequently not need to be so steep during the remaining forecast period. We do not expect Deputy Governor Svensson to vote for another rate cut. Despite the better-than-expected economic data published over the past few weeks, we believe that the Riksbank will not tighten rates until the ongoing economic recovery proves itself well established. Moreover, the Riksbank is seeking a Krona appreciation in the coming years. Thus, it is highly unlikely that rates will be raised before other Central Banks (i.e. the ECB). Subsequently, we do not pencil in a rate hike by the Riksbank before H2 ’10. Nonetheless, we believe that the Riksbank will raise rates higher than actually forecasted.

martedì 9 febbraio 2010

US and Euro Zone Bond Market Outlook

Since its inception, we have not incorporated any bond asset class categories in our Top Down Portfolio.

This is simply because the “Top Down Portfolio” is designed to replicate the asset allocation of a diversified macro hedge fund and is therefore well suited for the most aggressive section of any active investor’s portfolio. Considering our preference for momentum strategies, we have seen many equity markets (especially emerging markets) and some currency exchange rates (i.e. AUD/JPY and NOK/SEK) offering a better risk/rewards profile compared to bond markets, while Gold and Silver provide stronger protection against the potentially increasing risk premiums on the international financial markets.

However, we are well aware that bonds are usually the main asset class category in investment portfolios, going unaltered even through the steep yield decline over the past few years. Nevertheless, according to the latest US data gathered by Michael Belkin, author of “The Belkin Report”, only USD24bn had gone into various kinds of equity funds over the entire recovery rally starting in March ’09, versus USD178bn into bond funds.

Accordingly, this week’s “Global Strategy Weekly” will be analyzing bond market perspectives in both the US and Euro Zone, though we shall not be altering the 10 asset class categories in our “Top Down Portfolio”.

In the “Global Strategy Weekly” published on 18 January entitled “What is the yield spread telling us?” (look here for an exerpt), we underscored that very steep yield curves (the spread between 3m US T-Bills and 10y T-bonds is still well above 300bp) are usually followed by a decrease in long term rates and an increase in short term rates. We are of the opinion that a flattening yield curve in both the US and Euro Zone (we consider the German bond market as a benchmark) is the most likely scenario in the medium term.

With short-term Government Bond yields close to historical lows in both the US and Euro Zone, we see very few reasons to invest in them now. Thus, investing in short-term Government Bonds would make sense solely in the event of fresh financial turmoil, or should deflationary pressures resume. More uncertainties surround the outlook of long-term Government Bond yields. On the one hand, we are skeptical insofar as the decline of long-term rates in the next few months, as the steepness of the yield curve would indicate. Indeed, despite huge advances since its lowest level, posted in December 2008 (at 2.42% in the US and at 2.95% in Germany), long-term yields still remain low, especially considering the global economic recovery. On the other hand, we cannot agree with the general belief that yield may climb much further in the next few quarters (the economists in December’s Livingston survey conducted by the Federal Reserve Bank of Philadelphia predicted that rates may rise to 4.1% in the US by the end of 2010, and to 4.64% by the end of 2011).

Further, we estimate that economic growth in the US and Euro Zone over the next few years is likely to be subdued, since the potential growth rate has declined following the past two years in crisis. Moreover, the deleveraging process that would take place in major developed countries (i.e. total Debt as % of GDP is at 296% in the USA and at 285% in Germany) should eventually take its toll on economic growth.

Two other factors will play a positive role in lowering long-term yield in the next few quarters. US long-term Government yield will continue to benefit from foreign purchasing of US bonds. According to the paper “International Capital Flow and US interest rate”, the Federal Reserve’s economists Francis Warnock and Veronica Warnock demonstrate that foreign flows have an economically large and statistically significant impact on long term interest rates. While a slowdown of foreign buying is possible, the prospects of international investors completely abandoning the US market in the months ahead are unlikely. For this reason, foreign acquisition of US bonds should likely continue benefiting the US economy.

In the Euro Zone, difficulties surrounding the outlook of peripheral countries are likely to have a positive effect on German Bonds, which should continue to be seen as a safe heaven.

Our main scenario is that long-term Government Bond yields in the US and Euro Zone should rise in the short term (especially in the US), which is in line with economic recovery gathering momentum in early 2010, and then decline when the respective Central Banks begin increasing rates in H2 ’10, with investors setting off to discount more moderate economic growth and lower inflationary pressures. While we are not recommending investing in long-term government bonds now, we do see the potential for long-term Government bonds to gain positive returns in the next few months. We believe that the best choice for bond investors is to have their portfolios buttressed to last as long as possible.

Notwithstanding the above, a sudden increase in inflation is the main risk to our projection. In the working paper “Inflation Hedging for Long-Term Investors”, published in April 2009, IMF’s economists Alexander Attiè and Shaun Roache verified that “long-term treasury bonds are the worst performing asset class in the immediate aftermath of an inflation shock as yield increase”. However, the two economists also noted that “after about 3 years the return dynamics begin to work in favor of long-term treasuries, albeit gradually.”

Nonetheless, we believe that the prospects of a big spike in inflation are slim due to slack capacity utilization and the effects of deleveraging process on consumer spending, which we have emphasized previously. We substantially concur with the economists’ consensus in the Livingston Survey, in that consumer price should rise by 2.2% in 2010, and by 1.8% in 2011. The break-even inflation rate for the next 10 years (implicit in the TIPS) is at 2.27%.

Should inflation rise well above current expectations, bond investors should switch to inflation-linked bonds.

lunedì 8 febbraio 2010

The Week Ahead in US: retail sales and U.Michigan consumer confidence Index

From our weekly Top Down Outlook

Trade Balance (Wednesday 10) – With consumer spending rebounding at the tail end of the year, we expect exports to increase more than imports in December, widening the trade balance deficit. Our estimate is for imports to increase by 2.6% to USD179.12bn and exports by 2% to USD141bn. Should our estimates prove correct, trade balance surplus may rise to USD38.1bn.

Retail Sales (Thursday 11) – Retail sales figure were highly volatile over the last few months, probably reflecting problems with adjusting data for seasonal issues. Retail sales rose by 1.2% m/m in October, by 1.8% in November, and fell by 0.3% m/m in December. Notwithstanding December’s decline, the underlying trend in retail sales remains solid, and we expect the sales’ climb to resume in January. We project retail sales to increase by 0.6% m/m in January (3.8% y/y), and by 0.9% m/m ex-auto (4.3% y/y). These figures would suggest that a consumer spending rebound is likely to continue in early 2010.

Michigan Sentiment Index (Friday 12) – The Michigan Sentiment Index rose to 74.4 in January, up from 72.5 in December. Given the broad sell-off in equity markets over the past few weeks, labor markets still bogged down, and notwithstanding signs of an emerging bottoming-out in the last few months, we do not pencil in a sizeable short-term improvement in consumer confidence. We expect the Michigan Sentiment Index to remain unchanged at 74 in February, remaining well below the long-term average (89.6), which indicates that consumer spending recovery may remain subdued.

venerdì 5 febbraio 2010

Monetary policy Update: a review of CB's Meeting over the past week

The ECB decision to leave rates unchanged at 1% at the end of last week’s monetary policy meeting was widely expected. Addressing the press after the meeting, President Trichet reiterated the outlook depicted at last month’s monetary policy meeting with respect to a cautious approach to current recovery, emphasizing the temporary nature of the stimulus and strengthening the view that inflationary pressures would remain subdued in the medium-term. However, the most important element of the press conference was Trichet’s indication that in March “the Governing Council will take decisions on the continued implementation of the gradual phasing out of the extraordinary liquidity measures that are not needed to the same extent as in the past”. As regards the interest rate outlook following last week’s ECB monetary policy meeting, we see no reason to alter our estimate that rates are likely to remain unchanged, at least until the end of H1 2010, where they should gradually climb to 1.5% by the end of 2010, in line with our projections on downside risk.

Following last week’s monetary policy meeting, the BoE announced its widely-expected decision to leave rates unchanged at 0.50% and to pause its asset purchase program totaling GBP200bn. In a statement released after the meeting, the BoE said that “the Committee will continue to monitor the appropriate scale of the asset purchase program and further purchases would be made should the outlook warrant them.” It appears that the BoE is keeping the door open for a possible expansion of the program, though it does not expect to do so at this stage. The Inflation Report due for publication last week will give more information on the BoE’s economic outlook for the months ahead.

The Norges Bank decided to leave rates unchanged at 1.75% at the end of last week’s monetary policy meeting. The CB indicated that “activity in the Norwegian economy has increased, but capacity utilization is still lower than normal”. Other important factors influencing the outlook of monetary policy were “house price inflation is high and growth in household credit remains relatively strong” and “at end-January” the Krone was a good 1.3% stronger than projected for the first quarter in the October 2009 Monetary Policy Report. The result of last week’s meeting is in line with our base scenario; hence the Norges Bank should increase rates to 2% at the next monetary policy meeting scheduled on 24 March. According to our estimated equilibrium rate model, the NB’s ever-tightening monetary policy is likely to continue in the months ahead: the Key rate may rise to 2.75% by year-end.

The Reserve Bank of Australia (RBA) surprised markets by deciding to leave rates unchanged at 3.75% during last week’s monetary policy meeting. This came after having increased them by 0.25% in each of the last three monetary policy meetings in 2009. All 20 economists in the Bloomberg survey predicted a rate hike.

In the press release published at the end of the meeting, Governor Glenn Stevens explained that “since information about the early impact of those changes is still limited, the Board judged it appropriate to hold a steady setting of monetary policy for the time being”. However, Stevens added that “interest rates to most borrowers nonetheless remain lower than average. If economic conditions evolve broadly as expected, the Board considers it likely that monetary policy will, over time, need to be adjusted further in order to ensure that inflation remains consistent with the target over the medium term”. Although, last week’s decision to leave rates unchanged came as a surprise, we believe that further rate hikes in the months ahead are still a clear possibility. Moreover, should employment and home loans data, which are due for publication sometime next week, come out higher than expected, the RBA may decide to raise rates again at next month’s monetary policy meeting.

mercoledì 3 febbraio 2010

ECB and BoE decisions' on extraordinary measures expected

From our latest Top Down Outlook:

The ECB is widely expected to leave the rate unchanged at 1% at the close of its monetary policy meeting on Thursday, since economic data published in the last few weeks did not change the economic outlook depicted by ECB Chairman Trichet during the latest press conference in January. While economic activity continued dilating at the end of 2009, uncertainty as to the sustainability of current economic recovery remains high as a number of supporting factors are merely temporary. Moreover, inflationary pressures have been well contained and are expected to remain below the ECB’s 2% target both in 2010 and 2011. Trichet also emphasized that the ECB will continue supporting the credit market, but will gradually phase out extraordinary liquidity measures. We estimate that rates are likely to remain unchanged at least until the end of H1 2010, gradually rising to 1.5% by the end of 2010. Nevertheless, we believe that the running risk facing our projections is that rates may be lower and not higher than our year-end estimate.

With interest rates expected to remain unchanged at 0.5%, the main item of interest of Thursday monetary policy meeting will be the BoE’s decision on the asset purchase programme. At the end of January’s monetary policy meeting, the BoE announced that thus far the purchase of GBP193bn out of GBP200bn has been made and that the programme shall take another month to complete. We believe that the BoE may decide to stop the programme in February as the economy is showing signs of bottoming out from recession. However, we believe that a rate hike by the BoE is hardly at hand. The latest economic data published in the UK (i.e. Q4 GDP figures) indicates strong prospects of economic activity rebounding in the next few months, though economic recovery is likely to be subdued. Moreover, even if the CPI rose to 2.9% y/y in December, and possibly exceed 3% in January, inflationary pressures are likely to soften in the months ahead. We do not pencil in a rate increase by the BoE, at least until Q4 2010. The inflation report of 10 February and the ensuing press conference by BoE Governor King will further detail the BoE’s monetary policy outlook.

Iscriviti a:

Post (Atom)