This is an excerpt from our weekly Top Down Outlook. To subscribe a 1 month free trial go to our website

Equity markets in emerging countries gained spectacular returns ever since major equity indices began their overall upward trend in March ’09: the MSCI East Euro advanced by 81%, the MSCI Emerging Asia by 102% and the MSCI Latin America by 67%. Unsurprisingly, these indices were also the hardest hit by sell-offs in the past two weeks. Compared to 2010’s highest value recorded in the first days of the year, the MSCI East Euro declined by 6.2%, the MSCI Emerging Asia by 7.5% and the MSCI Latin America by 6.3%.

Equity markets in emerging countries gained spectacular returns ever since major equity indices began their overall upward trend in March ’09: the MSCI East Euro advanced by 81%, the MSCI Emerging Asia by 102% and the MSCI Latin America by 67%. Unsurprisingly, these indices were also the hardest hit by sell-offs in the past two weeks. Compared to 2010’s highest value recorded in the first days of the year, the MSCI East Euro declined by 6.2%, the MSCI Emerging Asia by 7.5% and the MSCI Latin America by 6.3%.

The negative performance over the past two weeks weighted on our Top Down Portfolio, as we recommended buying the whole of the emerging countries’ equity markets since the inception of the Portfolio. However, even after the correction over the past two weeks, we are not going to change our buy recommendations on these markets because the majority of the elements spurring the emerging markets rally are still soundly in place.

The most important factor supporting equity emerging markets are the expectations that economic growth is likely to be robust both in 2010 and 2011. For instance, in the World Economic Outlook Update released over the last week, the IMF raised its estimate for GDP growth in emerging and developing economies compared to 2009 WEO projections, from 5.1% to 6% in 2010 and from 6.1% to 6.3% in 2011. This major upward revision concerned Asia, which is projected to grow by 8.4% both in 2010 (against the 7.3% forecasted in November) and 2011 (8.1%). China is expected to continue growing at a robust pace, with a 10% GDP growth projected in 2010.

Nonetheless, news sources coming from China are the main reasons behind the underperformance of Asian/ex-Japan equity markets in the last few weeks. After the higher than expected GDP growth in Q4 ’09 (+10.7% y/y), Chinese authorities have initiated the first restrictive measures to slowdown credit growth and to curb inflationary pressures (1.9% y/y in December). In fact, the People’s Bank of China raised the ratio for required reserves, the timing of which was earlier than expected for the market. The PBOC also raised its 3-month, 6-month and 1 year bill over the past weeks. However, rumours that major banks were said to stop lending were denied.

While the markets were disappointed by signals of a more restrictive monetary policy in China, which dragged down commodity prices and should most likely trigger lower economic growth, we believe that this decision is the consequence of both strong economic growth and the Chinese Authorities’ willingness to curb excessive credit growth, subsequently precluding much bigger problems in the months ahead. The sharp increase in the country’s debt pile throughout 2009 (new loans amounted to 9.21 trillion Yuan in 2009 and they are expected to fall to 7.5 trillion Yuan in 2010 according to Morgan Stanley estimates) is indeed a big concern when considering the forward course of China’s financial stability. For these reasons we see the PBOC decisions as positive in the medium term.

Emerging markets are also likely to continue benefiting from excessive liquidity created by the major central banks around the world. Although the improvement in economic activity, monetary policy is likely to remain expansive in the major international economies. This is especially true in the USA, Euro zone, UK and Japan. As we have pointed out in past editions of “Global Strategy Weekly”, we believe that the Fed, the ECB and the BoE shall start increasing rates in H2, while the BoJ is expected to leave rates unchanged for the whole of 2010 (and probably 2011). This means that rates are likely to remain below their neutral levels for all of 2010. Contrariwise, Morgan Stanley analysts pointed out from a recent investigation that emerging countries’ central banks could hike rates sooner than expected due to strong economic growth. The tightening monetary policy in EM will bring capital inflows, a strong basis for expecting continued economic and asset overperformance.

Finally, the most important emerging markets may benefit from the lower leverage of the economy as a whole when compared with most developed countries. A recent study conducted by the McKinsey group showed that the total debt/GDP is much lower in developing countries than in developed countries. The deleveraging process that would take place in developed countries over the next few years would drag economic growth in these countries for many years to come, making the outlook of emerging countries appear rather rosy.

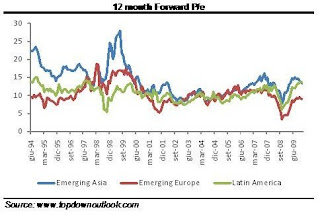

Moreover, albeit the recent strong upward trend, emerging markets do not appear as excessively overvalued at current levels. Indeed, the 12 month forward P/e is below historical average both in Asia (13.2x versus 14x) and Emerging Europe (8.9x versus 10.4x) and it is above the historical average only in Latin America (13.6x versus 10.6x).

We would reiterate our buy recommendation on emerging countries equity markets in view of the trend for these indices to remain on the upside. Indeed, notwithstanding the recent correction, the whole of the benchmark indices are still well above the respective 200-day moving average, and our preferred momentum indicators (based on performance in the latest 1 month, 3 month, 6 month, 9 month and 12 month), which gave a buy signal at the end of April ’09, are still positive. Should these indicators turn negative, we would reconsider our position on the indices.

Nessun commento:

Posta un commento