Last week, the BoE decided to leave rates unchanged at 0.5% and to forestall expanding on its GBP 200bn asset-purchase program, which was widely anticipated by the whole of economists in the Bloomberg consensus. It was hard to see any reason for the BoE to change the outlook for monetary policy in the short term, having decided to pause the program in February.

The latest economic data confirmed that the wait-and-see stance recently adopted by the BoE is appropriate. Over the last week, GDP growth in Q4 was revised upwards from 0.1% q/q to 0.3% q/q; the CIPS Manufacturing Index remained well above 50 in February (56,6, unchanged from January); and the CIPS Services Index rose from 54,5 in January to 58,4 in February. However, these data confirmed that the UK economy is likely to grow at a moderate pace in the next few quarters and will not recover the pre-crisis growth trend for many years, as BoE’s Governor Mervyn King stressed in the press conference for the presentation of February’s Inflation report.

Neither the higher than expected increase in inflation is likely to change the monetary policy outlook in the short term. Indeed in January inflation jumped from 2.9% y/y to 3.5% y/y, requiring the BoE’s Governor to write a letter to the Chancellor to explain the reasons for the CPI leaping above 3%. Three factors have driven inflation up: 1) standard VAT rate restoration to 17.5%; 2) oil price increases over the past year; 3) exchange rate weakness. While inflation is expected to remain well above 3% in the short run, Mervyn King confirmed that inflation will fall below 2% in H2 ‘10. Only in the case the expected downtrend in inflation fail to materialize, the BoE monetary policy outlook will change.

However, even if inflationary pressures prove to be higher than expected, we do not see the BoE tightening up monetary policy. Indeed, an increase in inflation would contribute in solving a major problem in the UK economy: the high level of total debt compared to GDP. According to data published in the McKinsey Group’s report “Debt and deleveraging: The global credit bubble and its economic consequences”, the UK has a total debt/GDP ratio of 466%, compared to 296% in the USA and 285% in Germany. Only Japan at 471% has a higher ratio.

The high debt/GDP burden will likely drag the UK economy as both household and business sectors should embark on a deleveraging process in the years ahead. Consumer spending and business investments are likely to remain moderate for many years. A different trajectory is likely to be taken by public debt, which is expected to grow considerably in the next few years. The projections in the 2009 budget see an increase in public debt from 71.9% in fiscal year 2009/2010 to 82.1% in 2010/2011, reaching 90.7% in 2013/2014. However, in the next few years, even government spending is likely to be put under control facing these large deficits.

Weak domestic demand and high levels of debt are factors that may contribute to a BoE’s expansionary monetary policy for a lengthy period and, moreover, longer than its major trading partners. In fact, a more protracted monetary easing from the BoE compared to the Fed and the ECB, in view of a higher level of inflation, will lead to further depreciation of the Pound in the coming months, hence favoring exports. In fact, exports at this time seem to be the British economy’s only hope for a return to sustainable growth. BoE’s Governor King has on many occasions pointed out that a depreciation of the Pound would be welcomed, highlighting the positive role of a weaker Sterling in increasing the profits of export companies and limiting deflationary pressures (which are still seen as the chief reason for concern within the Bank of England).

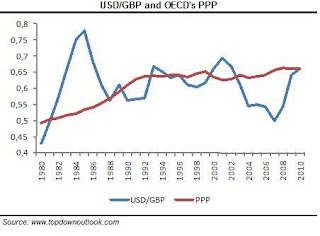

Thus, the Sterling’s fall in value since the beginning of the year against both the US dollar (-7%) and the Euro (-2%) is likely to be seen favorably by the Bank of England. The decline in early 2010 resulted in a Sterling that is fairly valued versus the US Dollar based on the OECD’s estimate of Purchasing Power Parity and 15% undervalued against the Euro.

The decline of the Pound against the Euro and the US Dollar had a negative impact on both European and U.S investment in British assets. A clear example of this is the trend of some ETFs on British assets quoted on Italian equity markets: DB Trackers Eonia, Ishares Ftse UK Gilt and Ishares Ftse100.

The former has lost 1.7% year-to-date, while the ETF specializing in long-term bonds has gained 0.8% year-to-date, though it has lost 0.6% compared to March ‘09 due to higher yields.

However, the negative impact of developments in the British Pound on asset performance is very clear when looking at the development on the FTSE100’s ETF. Therefore, compared with the 2.1% year-to-date gain recorded by the FTSE 100, the best performance among the major stock markets in Europe, the ETF we took into account has gained only 0.9%.

These performances are a reminder of the words delivered in January ’09 by Jim Rogers, co-founder and former member of the Quantum Fund, angering many British investors and commentators: "Sell any Sterling you might have. It's finished. I hate to say it, but I would not put any money in the UK”. As long as the outlook on the Pound is not stabilized, which does not appear likely in the short term due to numerous uncertainties about the outlook of the British economy, not least the result of forthcoming elections, the advice of Rogers still has relevance.

Nessun commento:

Posta un commento