In line with last week’s emerging data, the most likely scenario for the next few years divides the Euro Zone into two, with the major northern European countries growing at a healthy pace and the peripheral southern European countries, including Ireland, remaining in a quandary for several years. On the one hand, the German IFO and French INSEE business confidence indices showed positive gains in March, indicating that the two largest economies in the Euro Zone could accelerate in the coming months. On the other hand, fears about the health of public finances in Greece and Portugal increased after UBS economist Paul Donovan predicted that Greece will fall into default at some point, and after the ratings agency Fitch downgraded Portugal to AA- with a negative outlook, indicating that further economic or fiscal underperformance this year or in 2011 may lead to another downgrade. According to Fitch, “although Portugal has not been disproportionately affected by the global downturn, prospects for economic recovery are weaker than 15 European Union peers, which will put pressure on its public finances over the medium term.”

However, the real commotion continues in Greece. Greek authorities are indeed faced with the particular dilemma of having to refinance a debt of 20 billion Euros between April and May. Only last Thursday, governments of the 16 Euro Zone countries endorsed a Franco-German proposal mixing IMF and bilateral loans at market interest rates while voicing confidence that Greece will need no outside help to cut Europe’s biggest budget deficit.

Nevertheless, the most clear and prominent revelation from data published last week is that the countries called to assist Greece in exiting the crisis are those who are particularly benefiting the most from this situation. Indeed, the most important effect of the Greek crisis in financial markets, in addition to the jump in Greek government yields, was the decline of the Euro against major international currencies. Year to date, the Euro has lost 6% against the U.S. Dollar, 3.7% against the Swiss Franc, 7% against the Japanese Yen and has gained solely against the British pound (1.3%).

A study entitled Standard Shocks in the OECD Interlink Model presented in 2001 by a handful of OECD economists, namely Dalsgaard, Andrè and Richardson, indicated an estimated 0.6% increase in the Euro Zone’s GDP both in the first and second year following a 10% depreciation of the Euro. The projected rise in the inflation rate (+0.4% in the following two years) should not be cause for concern as the ECB projected inflation to remain well below 2% in both 2010 and 2011. The Eurostat’s CPI flash estimate for March set to be published sometime next week should confirm the scenario projected by the ECB: consumer prices at 1% y/y, hence a slight increase from February’s 0.9% y/y. Inflationary acclivity should depend almost exclusively on rising oil prices, while the CPI core, scheduled to be published in the next few weeks, should remain near its all-time low of +0.8% y/y recorded in February.

Figures from the OECD indicated that a decrease in the single European currency caused by the Greek crisis is especially good for Germany and France, whose business confidence indices rose strongly in March. Germany may be the main beneficiary of the Euro’s decline as exports account for 48% of the German GDP.

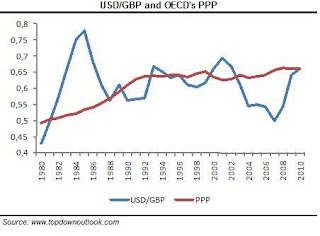

This is especially true considering that the Euro is still overvalued against the US Dollar on the basis of estimated purchasing power parities calculated by the OECD, notwithstanding the recent downtrend. The OECD, in fact, estimated the fair value for the Euro/Dollar at 1.17.

Nonetheless, the Euro’s decline is likewise very positive for its peripheral countries. Another stumbling of the single European currency would enable Greece, Spain and Portugal to gain competitiveness in international markets, promoting an increase in exports, which would appear to be the only factor capable of boosting economic growth in the coming years. A low or negative GDP growth would in fact lead to a further deterioration of public finances.

It would be much more difficult for these countries to gain competitiveness against other European partners. The strong increase in unit labor cost and real exchange rate over the past few years (as indicated in the graphs below) eroded the competitive position of the Euro Zone’s peripheral countries vis-à-vis major countries of the region. Northern European countries, particularly Germany, do not seem to want to give up their model of growth based on exports or implement economic policies to boost domestic demand in exchange for a more competitive Spain, Portugal and Greece (and Italy). European partners are facing a long and arduous process, which must necessarily pass through a stage of very low wage growth, if not negative, with a strong risk of deflation. Thus, while last week’s decision on aiding Greece might reduce tensions on these countries in the short term, overcoming the current crisis for peripheral countries is a process that will take many years.