PMI manufacturing

indices for August released today strengthened the view that Euro zone economy

could extend the rebound started in Q2 – when GDP rose by 0.3% q/q – in H2 ’13.

Euro zone PMI manufacturing index rose from 50.3 to 51.4, above an estimate of 51.3 published on Aug. 22. A

reading above 50 indicates growth.

Euro zone

figure is in line with a slight recovery in Q3 and Q4. Economic activity could

improve in the quarters ahead but the risk of a return to recession in case of

negative shocks are still very high, in our view.

Indices

were above 50 in all major Euro zone countries, with the exception of France:

1) German PMI rose from 50.7 to 51.8

(flash estimate 52.0). The revision in Germany does not seem meaningful. The

trend remains positive and industrial

production is expected to continue growing in the months ahead despite market

expectations for a correction of orders and output in July (data are due during

the week);

2) French PMI remained unchanged at 49.7.

French data could increase concern on the recovery there. However, INSEE index

for August rose more than expected, giving an opposite message compared to the

PMI index. French outlook is still worrisome as competiveness is low and public

finance continue to deteriorate;

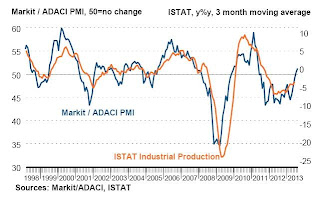

3) Italian PMI rose from 50.4 to 51.3 –

the 27 month high of the index;

PMI indices

also rose in Netherlands - from 50.8 to 53.5 – and in Spain – from 49.8 to

51.1. In Europe, UK PMI manufacturing index climbed from 54.8 to 57.2.

Positive news

also came from China, where PMI manufacturing index was at 51.0 against market

expectations at 50.6.

However,

the picture in the emerging Asia ex-China was less positive, with indices below

50 - signalling contraction for the sector - in South Korea, India, and

Indonesia.