An excerpt form our latest Top Down Outlook. Go on our website for a 1 month free trial.

Over the last few weeks, investors have been focusing on the negative outlook for peripheral Euro Zone countries, especially Greece, due to their high deficit and public debt. However, albeit at a slower pace, uncertainties over the future of public accounts concern a vast majority of developed countries. For instance, public debt, in % of the GDP, may rise to 65% in the USA, 88.2% in the UK in 2011 and 83.7% in the Euro Zone as a whole.

Over the last few weeks, investors have been focusing on the negative outlook for peripheral Euro Zone countries, especially Greece, due to their high deficit and public debt. However, albeit at a slower pace, uncertainties over the future of public accounts concern a vast majority of developed countries. For instance, public debt, in % of the GDP, may rise to 65% in the USA, 88.2% in the UK in 2011 and 83.7% in the Euro Zone as a whole.

Notwithstanding the above, the country that may suffer the most in the next few years due to elevated public debt is Japan. Indeed, public debt ballooned in the last two decades from 59% of the GDP in 1990. Further, the International Monetary Fund estimates that debt may have risen to 218% in 2009, and thus could reach 227% and 246% in 2010 and 2014 respectively. This jump in public debt substantially replaced the falling private sector debt, increasing the level of total debt/GDP, according to data from McKinsey Global Institute, from 420% in 1995 to 471% in Q2 ‘09. We used 1995 as a benchmark year, since this is when non-financial business debt reached its highest level (148% of GDP). After 1995, non-financial business sectors began a deleveraging process that finished only recently (non-financial business debt fell to 91% of the GDP in 2005 and now stands at 95% of the GDP).

Despite the huge increase in public debt and the estimated further increase in the years ahead, government bond yields have remained very low. The 10-year Japanese Government Bond yield has been below 2% since 1998, with no meaningful changes over that period. By now, Japan holds the record for both the highest general government debt and the lowest long-term government yield among developed countries; which is in stark contrast with economic theory.

The grounds for this “conundrum” are explained in a recent working paper “The Outlook for Financing Japan’s Public Debt” by IMF economist Kiichi Tokuoka, who enumerated the factors behind the low and steady JGB yields:

1) Large pool of household assets: household saving rate was around 10% until around 1999 when it began to decline sharply;

2) Strong home bias: JGBs have been financed largely by domestic investors (94 %of holdings as of end-2008), who may exhibit more stable behaviour than foreign investors. The strong home bias is driven by the household sector whose appetite for risk assets has remained weak. The share of currency and deposits in households’ financial assets is as high as 55% (at end FY2008)—well above 16% in the U.S.—and a large part of these funds is invested in JGBs mainly through the banking sector;

3) Existence of large and stable institutional holders as the Japan Post Bank and the Government Pension Investment Fund;

4) Recent large saving flows from the corporate sector.

Nevertheless, Tokuoka explained that structural shifts in the Household Balance Sheet and key market players could weaken the absorptive capacity of the JGB market, making yield more sensitive to the debt level. For instance, the role of the household sector in providing funds to the JGB market is likely to decline as the savings rate may further fall from the current level (2.2% in 2007). The author’s simulation indicated that, based on current trends, the gross public debt in 2015 could exceed gross households’ financial assets, that is, of course, assuming that the household saving rate remains at 2.2%.

Tokuoka concluded that it would be critical to establish a credible framework over the medium term to ensure fiscal sustainability. The framework would need to feature a clear timetable for comprehensive tax and expenditure reforms to be implemented once the economy recovers.

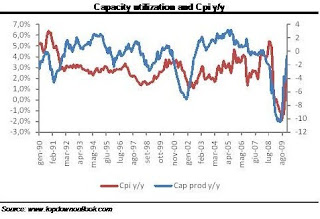

However, a shift in the expansionary fiscal policy adopted by the Government in the last few years is not yet on the horizon. The latest macroeconomic data, while posting a better than expected growth of 1.1% q/q GDP in Q4 ‘09, indicated that economic growth is mainly driven by exports in spite of the surprising rebound of both consumer spending and business investment. The most worrying aspect of Q4 GDP figures, however, was the 0.9% q/q decline of the GDP deflator – a 54 year low.

Deflation weighs on the Japanese economy in two ways: 1) it weakens consumer spending, and 2) it dampens business investments because real yield is higher than in the rest of the developed world.

This negative situation will unlikely change in the short term as the output gap is indeed very wide (about 7% according to the Cabinet Office’s estimate for July-September 2009), and a meaningful recovery is not expected over the next few months. Moreover, internal demand is likely to remain weak as wage declines are influencing sales over a broad range of discretionary goods, and investment spending will unlikely pick up considerably due to uncertainties on current economic recovery. For these reasons, only further significant improvements in exports could trigger a sharper upturn in the economy.

On the other hand, increases in exports are limited by the Yen's sharp appreciation in recent months, particularly against the U.S. Dollar and, consequently, the Chinese Yuan, which is pegged to the U.S. currency. Compared with its June 2007 peak, the Yen has advanced by over 27% against the U.S. Dollar, eroding profit margins for the nation's exporting companies. Based on the OCSE Purchasing Power Parity estimate, the current level of the Yen surpasses an overvaluation of 25% against the U.S. Dollar.

Therefore, a devaluation of the Yen is the most efficient way to spur growth in Japan’s economy in the short term, even though it appears difficult to implement, given that almost all major international economies rely more or less heavily on their currency devaluation to revive the economy. Moreover, both the Bank of Japan and the Treasury Minister seem to have limited possibility to implement further policy action to stimulate the economy. Last week, the BoJ left rates unchanged at 0.1% and did not take decision on its quantitative easing program.

All the same, we believe that should the Japanese Yen’s upward trend versus the U.S. Dollar resume in the months ahead, the Bank of Japan will be ready to take extraordinary measures to weaken the exchange rate, i.e., increasing lending term facility for commercial banks or raising government bond purchases. Fiscal deterioration is another factor prompting a decline of the Japanese Yen. We believe that there are no likely prospects of the Japanese Yen strengthening beyond its current level in the months ahead.

For this reason, we would not invest in any asset classes denominated in Japanese Yen. The Japanese equity markets have underperformed other major international equity markets. Thus, in view of potential Yen devaluation in the medium term and low bond yields, we recommend not to invest in the Japanese bond market.

Finally, the economic scenario for the Japanese economy we have depicted above reinforces our recommendation to BUY the AUD/JPY exchange rate, which fell in the previous weeks due to a surprising RBA decision to leave rates unchanged at 3.75% at February’s monetary policy meeting in conjunction with the increase in risk premiums on international financial markets. However, the AUD/JPY rebounded last week as the RBA made clear in the minutes of February’s monetary policy meeting that the tightening monetary policy will resume in the next few months. Following the higher than expected increase in employment in December, we foresee the RBA hiking rates to 4% as soon as in March. We continue to expect the Australian and Japanese Central Banks to each implement a highly restrictive and expansionary monetary policy in 2010 among major Central Banks, making the AUD/JPY the favorite exchange rates for carry traders.