Empire Manufacturing Index (Tuesday 16) – The Empire Manufacturing Index rose in January to 15.9 from 4.5 in December, indicating improved conditions for the manufacturing sector in early 2010 in the New York area. The data was substantially in line with indications coming from the ISM Manufacturing Index as regards the USA as a whole. The index is likely to indicate that industrial production will continue to trend upwards in the months ahead, remaining almost unchanged at 15.2. The equity markets’ decline in the past few weeks is likely to be the main reason behind the slight downtick in the index.

NAHB Housing Market Index (Tuesday 16) – Confidence among US Homebuilders dropped in January from 16 to 15 – its lowest level since June ’09. We expect the index to rebound to 16 in February, as real estate may begin feeling the effects of the tax credit extension and expansion for home buyers.

Housing Starts (Wednesday 17) – Housing Starts tumbled by 4% to 557k in December, with poor weather conditions probably taking their toll on the data. With weather conditions still negative for the sector in January, housing starts may have continued falling over the month: we estimate a 2% m/m decline to 545k. Housing Starts are likely to rebound in the months ahead thanks to a tax credit extension to June.

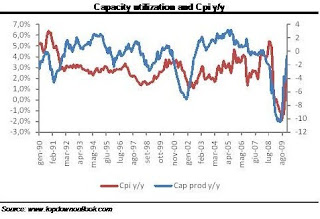

Industrial Production and Capacity Utilization (Wednesday 17) – Business confidence indexes rose in January (the ISM Manufacturing Index marked its highest level since August 2004), anticipating a continuance of the upward trend in industrial production. In line with the increase in the index of aggregate weekly hours, we estimate industrial production to rise by 0.5% m/m in January. Compared to January ’09, industrial production may rise by 0.9%, the first year-on-year positive change since March ’08. Capacity utilization is likely to increase to 72.3% from 72%. The index should nevertheless remain well below its historical average (80.6%), indicating soft inflationary pressures in the months ahead.

FOMC Minutes (Wednesday 17) – In line with our estimates, the FOMC upgraded its view on the US economic outlook in a statement released after its 27 January Monetary Policy Meeting. The FOMC confirmed that “economic conditions, including low rates of resource utilization, subdued inflation trends and stable inflation expectations are likely to warrant exceptionally low federal fund rate levels for an extended period of time”. However, this opinion was disputed by Kansas City Fed President Thomas Hoening, who said in the press release that “financial conditions had changed sufficiently that the expectation of exceptionally low levels of the Federal funds rate for an extended period was no longer warranted”. The minutes of the latest monetary policy meeting will furnish more insight on the particular views of the members of the Board of Governors concerning the economic outlook. In particular, it has to be seen whether other members, aside from Hoening, would have preferred removing the expectations of a low level Federal Funds rate for a long period, but might have decided to concur with the majority.

Consumer Price Index (Friday 19) – The Consumer Price Index rose to 2.8% y/y in December from 1.9% y/y in November, exclusively for the base effect in energy prices. The core inflation edged up to 1.8% y/y from 1.7% y/y in November, due to higher vehicle prices that were only partially compensated by shelter prices (unchanged m/m in December). We expect consumer prices to increase by 0.2% m/m and by 2.7% y/y in January as inflationary pressures are likely to remain subdued in the short term, hence reflecting low pricing power. Core inflation may edge up 0.1% m/m to 1.7% y/y.

Nessun commento:

Posta un commento